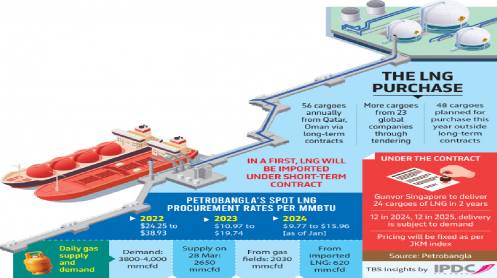

The government currently purchases spot LNG from 23 global companies, including Gunvor Singapore Ltd, through tendering and through long-term contracts from Qatar and Oman

Highlights:

Gunvor Singapore Pvt Ltd will deliver 24 cargoes of LNG in two years

12 cargoes this year, 12 next year, delivery is subject to demand

Govt imported 54 LNG cargoes from spot market from Sept 2021 to Jan 2024

To address surging domestic gas demand, the government has decided to purchase 24 cargoes of liquefied natural gas (LNG) from Gunvor Singapore Pvt Ltd under a short-term contract for the first time.

Each cargo will contain 33.60 lakh mmbtu (million British thermal units) LNG and the pricing will be determined based on the JKM (Japan Korea Marker) index.

The Cabinet Committee on Economic Affairs on 27 March approved in principle the procurement proposal sent by the Energy Division on 13 March.

Keep updated, follow The Business Standard’s Google news channel

Zanendra Nath Sarker, chairman of Bangladesh Oil, Gas and Mineral Corporation (Petrobangla), on 28 March told TBS, “This is the first time Bangladesh is importing LNG cargoes under a short-term contract. The company will deliver one cargo monthly, with the flexibility to adjust based on demand.

“Most Importantly, the pricing will adhere to the JKM formula, with additional terms favourable to Bangladesh. This arrangement is anticipated to benefit Bangladesh significantly.”

Energy Secretary Md Nurul Alam told TBS, “Gunvor Singapore’s proposal was approved by the Cabinet Committee on Economic Affairs at the latest meeting. Now, once the pricing is determined, it will be submitted to the Cabinet Committee on Government Purchases for final endorsement.”

When asked about the price proposed by Gunvor, the energy secretary said, “Bangladesh has six long-term contracts with different companies for LNG purchase. We have a clear understanding of the market price. Besides, Gunvor Singapore will adhere to a formula [JKM], making the evaluation process straightforward.”

Earlier on 10 January, the Singapore-based company proposed to the Energy Division to deliver 12 cargoes this year, and 12 cargoes in 2025.

On 4 March, Prime Minister Sheikh Hasina, who is also the minister of Power, Energy, and Mineral Resources, approved the procurement proposal process.

Currently, the government purchases spot LNG from 23 global companies, including Gunvor Singapore Ltd, through tendering and through long-term contracts from Qatar and Oman.

On 23 January, the cabinet committee on government purchases authorised the procurement of an LNG cargo from Switzerland’s Total Energies Gas & Power Ltd at a rate of $10.88 per mmbtu.

Another spot cargo from Gunvor Singapore Ltd is expected to arrive in April for which the government is paying $9.37 per mmbtu.

Other than spot LNG, the Energy Division also procures LNG from Oman and Qatar via long-term contracts, which are processed and supplied to the national grid by the two LNG terminals set up at Maheshkhali in Cox’s Bazar.

However, buying 24 cargoes from Gunvor Singapore marks the country’s first LNG procurement under a two-year contract.

The Energy Division now seeks to procure LNG through short-term contracts rather than long-term ones, attributing this decision to the fluctuating nature of LNG prices in the international market, which complicates sourcing.

A review of Petrobangla’s LNG procurement records from the spot market in recent years revealed fluctuating prices. In 2022, spot LNG was procured at rates ranging from $38.93 to $24.25 per mmbtu.

In 2023, Petrobangla purchased LNG at prices ranging from $19.74 to $10.97 per mmbtu. As of January 2024, the highest recorded price for purchased LNG stood at $15.96 and the lowest price was recorded at $9.77 per mmbtu.

Asked why Bangladesh is going to buy LNG under a short-term contract, Energy Secretary Md Nurul Alam said Bangladesh is procuring LNG in short-term contracts due to rising gas demand from industrial and power generation sectors. Ensuring adequate supply is crucial to prevent adverse effects on economic activities. Additionally, LNG will be purchased from the spot market as needed.

The energy secretary said Bangladesh receives 56 cargoes of LNG annually from Oman and Qatar under long-term contracts although the country can process 58 more cargoes per year as per the current capacity of the two LNG terminals.

“However, in recent years, spot market purchases have been limited due to pricing concerns. This year, a minimum of 48 LNG cargoes are slated for procurement outside long-term contracts, while at least 25 LNG cargoes are required from long-term contracts by next June,” Nurul Alam added.

Supply and demand

According to Petrobangla, the country’s gas demand is around 3800-4,000 million cubic feet per day (mmcfd).

Petrobangla data shows on 28 March, the country sourced 2030 mmcfd from domestic gas fields and 620 mmcfd from imported LNG, totalling 2650 mmcfd. Throughout March, the gas supply ranged from 2600 mmcfd to 2720 mmcfd.

Two floating storage and regasification units (FSRUs) with a daily capacity of 500 mmcf have been set up at Maheshkhali in Cox’s Bazar to regasify the imported LNG and supply it to the national grid.

One FSRU is owned by Excelerate Energy Bangladesh Limited, while the other is owned by the Summit Group. Summit’s FSRU ceased its operation in mid-January due to maintenance work. It is expected to resume gas supply in the first week of April. With the two FSRUs in operation, the country’s gas supply is expected to get a boost.